Taranga Ventures Launches $50 Million Media and Entertainment Global Fund

Dec 17, 2024

SMPL

Mumbai (Maharashtra) [India], December 17: Taranga Ventures has launched a $50 million Media and Entertainment Tech fund, with an additional green shoe option of $50 million. This fund aims to drive innovation in media technology, empowering companies to revolutionize content creation, consumption, and experiences.

Targeting high-growth sectors such as AdTech, OTT platforms, streaming, gaming, VFX, animation, blockchain, and content production, Taranga Ventures will focus on both early-stage and growth-stage companies. The fund also includes roll-ups and acquisitions in the evolving media and entertainment landscape.

The fund is led by a distinguished team:

* Addishree, with 30 years of expertise in M&A, banking, capital markets, FoFs, and investments, Founder at ED Global.

* Pradyuman Jhala, a Canadian investor with investments in real estate, golf, and pension funds, is a senior immigration professional.

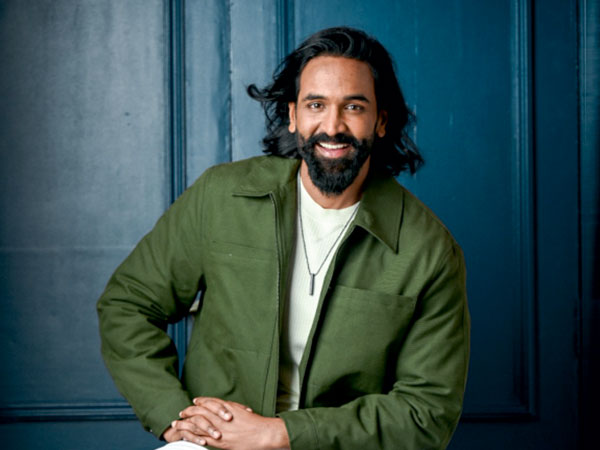

* Vishnu Manchu, Indian actor, producer, and entrepreneur, founder of Twenty Four Frames Factory, and president of the Telugu Movie Artists Association (MAA).

* Vinay Maheshwari, with 28 years of experience, former CEO of India TV & Sakshi Media Group, held leadership roles at DB Corp & Hindustan Times. Founder of SucStrat Pvt Ltd.

* Devesh Chawla and Satish Kataria, experts with over 35 years of combined operations and investor relations experience.

Partners are also in touch with Will Smith, renowned Hollywood actor, for a possible association with the fund.

Taranga Ventures has secured early commitments from industry leaders and large LPs and will register the fund in India and Delaware. Portfolio companies will benefit from funding as well as strategic guidance from a robust advisory network.

The fund's mission is to nurture transformative startups in the media sector, driving their success in a rapidly evolving market. With early-stage investments coinciding with a surge in media sector acquisitions and the rise of emerging technologies like AR, VR, and AI, Taranga Ventures is poised for substantial growth.

Taranga Ventures aims to achieve a 22% annual IRR over a 3+2 year lifespan with a balanced risk approach. The fund will be administered by Amicorp, ensuring transparency and operational excellence.

An exclusive investor briefing is scheduled for next week, marking the beginning of a new era in technology-driven entertainment and media innovation

(ADVERTORIAL DISCLAIMER: The above press release has been provided by SMPL. ANI will not be responsible in any way for the content of the same)